Customer Value Measurement

Using Customer Value Measurement to Improve your Unique Value Proposition

When faced with their next purchase decision, whose product or service is a customer most likely to buy? Will it be yours or will it be that of a key competitor?

This is the most important question most business managers will have to answer. Most of the time, customers will make that decision based on the benefits that are most valuable to them, and the price they must pay to receive those benefits. In other words, most purchase decisions are based upon perceived value – the trade-off between the quality of the most desirable benefits and the price paid for those benefits. Managing your organization’s unique value proposition effectively is the most critical responsibility of any senior business manager.

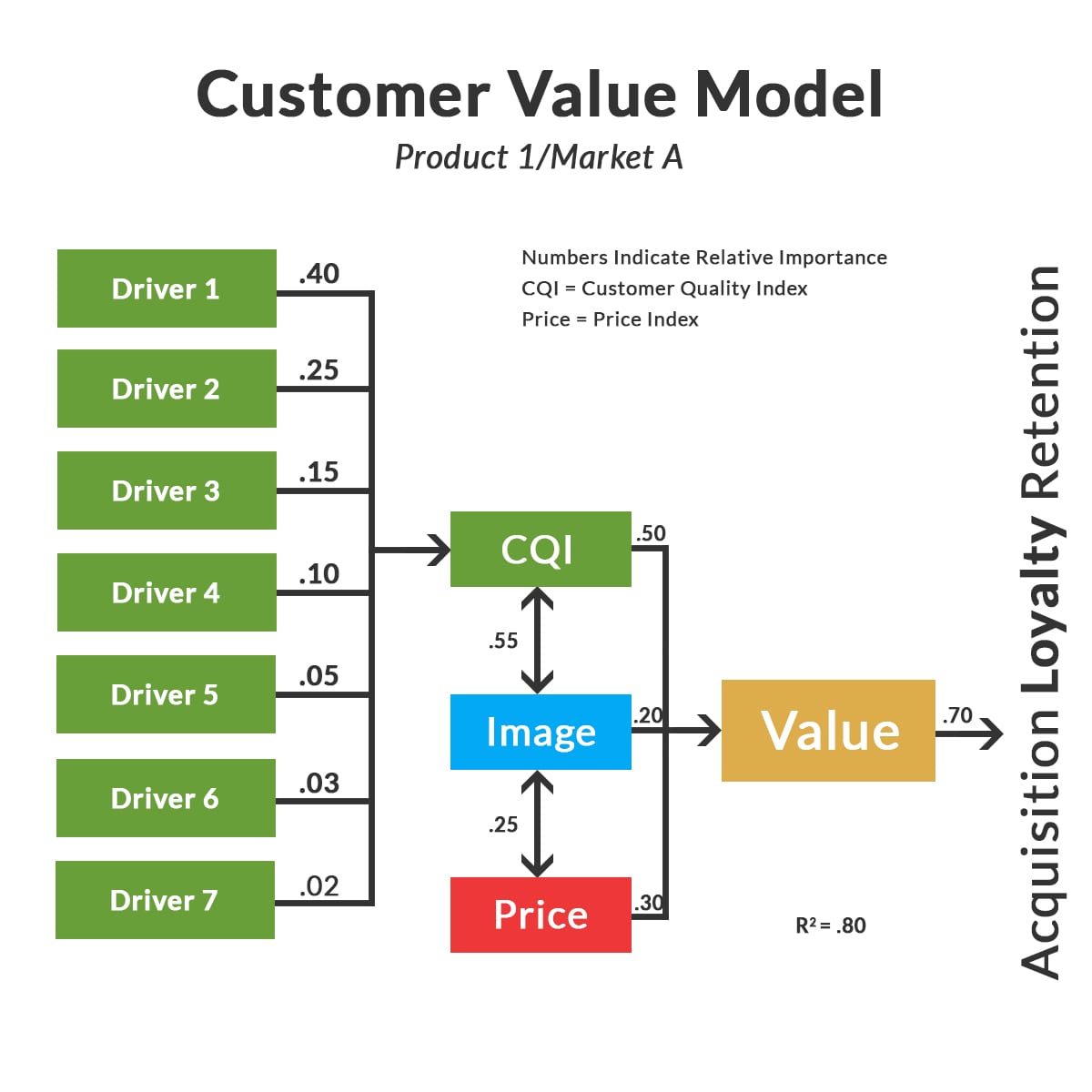

The first step is to define your value proposition based on what drives your customer’s perceptions of value. For that understanding, we provide 4 key value tools :

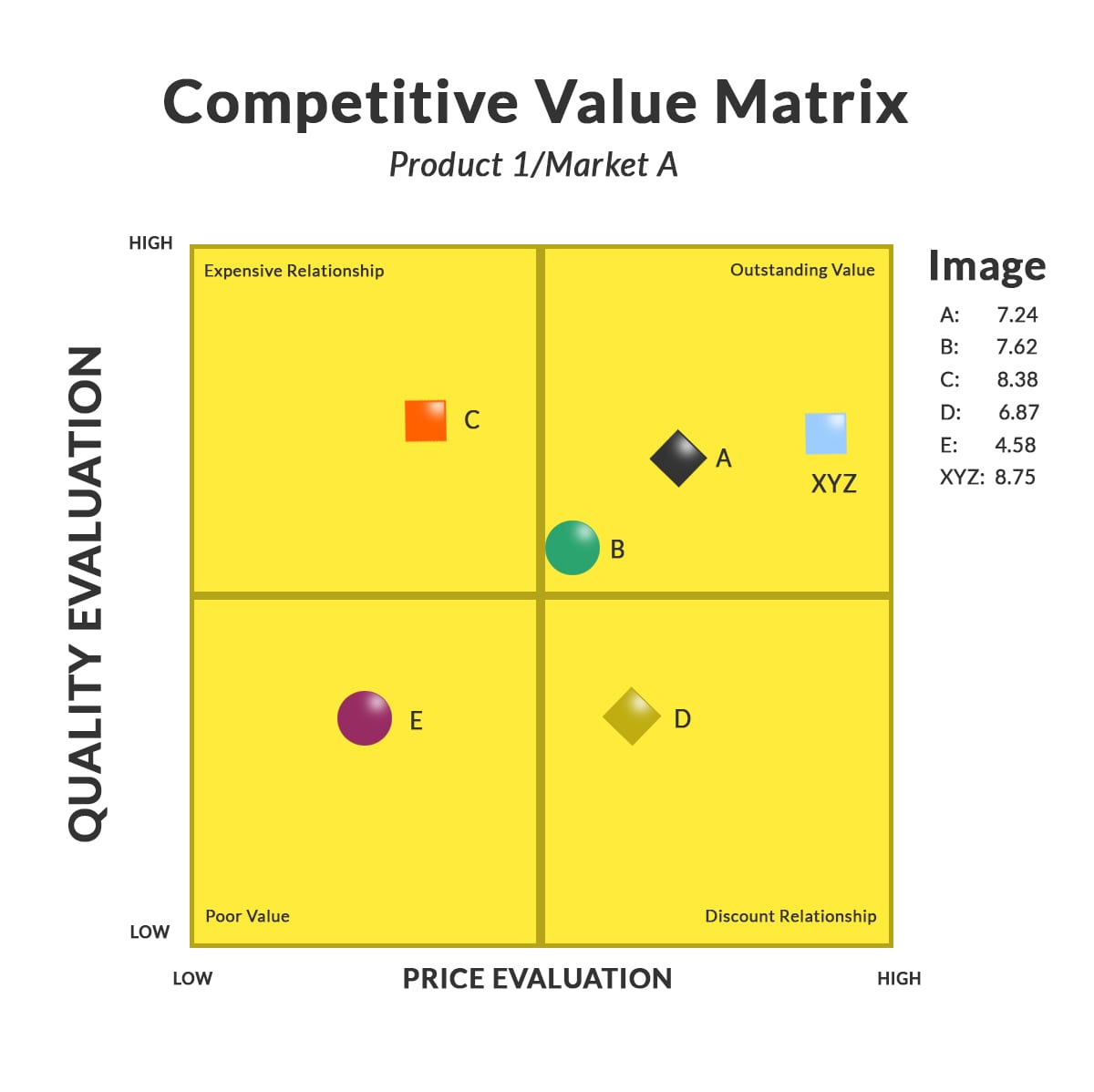

The COMPETITIVE VALUE MATRIX is based on the two key drivers of value – Quality and Price. Image ratings are provided outside the matrix. Competitors are located on the matrix based on their Quality and Price performance. The best value providers are located in the upper-right quadrant.

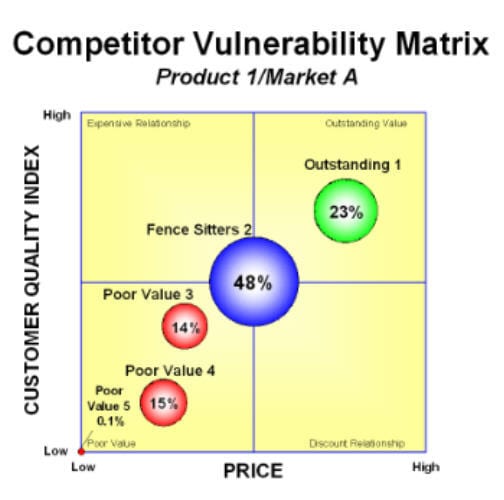

The CUSTOMER LOYALTY MATRIX is based on the two key drivers of value – Quality and Price. Instead of locating competitors on the matrix, however, the circles represent groups of XYZ’s customers. The most loyal customers are located in the upper-right quadrant. “Fence Sitters” are located toward the center of the matrix. The most disloyal customers are located in the lower-left quadrant.

Then, you need to know how those targeted customers perceive the value you provide relative to the value they could get somewhere else – Your Company’s Unique Value Proposition. Value does not exist in a vacuum. It is not an “absolute” thing. Customer perceptions of value are comparative assessments – value compared to what? For answers to this question, you need a Competitive Value Matrix.

The only reason to proactively manage your value proposition is to generate profitable increases in market share. Increasing market share involves getting new customers while simultaneously keeping the most profitable customers you already have. How loyal is your current customer base? How profitable are your most loyal customers? Answers to these questions come from the Customer Loyalty Matrix.

Finally, in order to effectively acquire customers from your competitors, you need to know what the vulnerabilities of those competitors are.

- On what basis does a competitor fail to deliver superior value to its own customers?

- Which customers are most likely to defect?

- Where’s the low-hanging fruit?

These questions can be answered with the Competitor Vulnerability Matrix.

Managing customer value requires measuring to understand how customers view your current competitive value proposition. Every organization has a competitive value proposition, whether it’s the one you intend to provide or not.

Do you know what your competitive value proposition is?